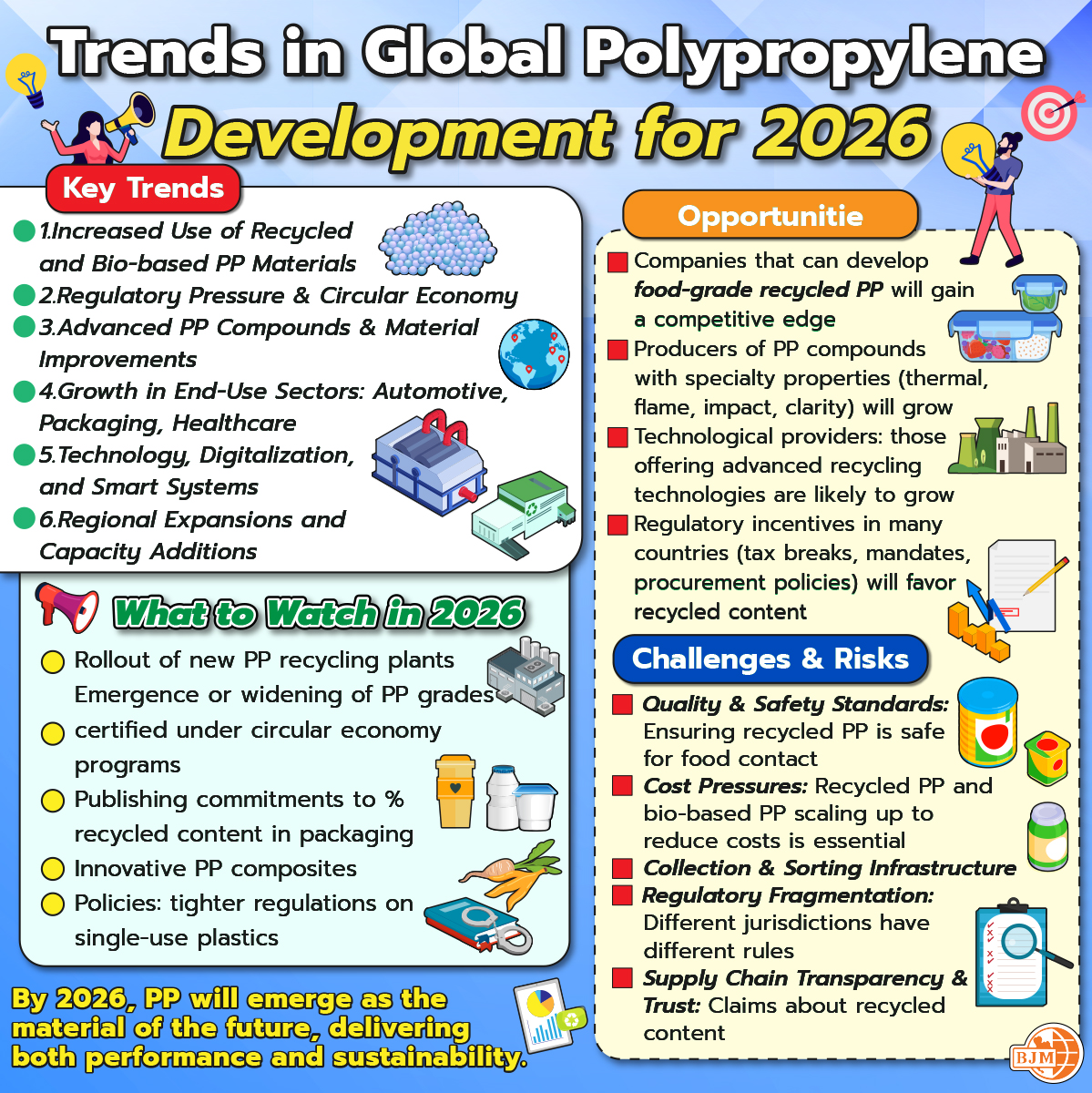

Polypropylene (PP) remains one of the most dynamic and strategically important plastics globally, due to its versatility, cost-effectiveness, and relatively favorable environmental profile compared to many non-recyclable or non-thermoplastic alternatives. By 2026, several intersecting trends are shaping how PP is developed, manufactured, regulated, and used. Below are key trends, opportunities, and challenges to watch.

Key Trends

1. Increased Use of Recycled and Bio-based PP Materials

- The drive toward sustainability is pushing manufacturers to adopt post-consumer recycled PP (rPP) and bio-based PP. Brands and regulators are demanding higher recycled content and lower carbon footprints.

- Technology in chemical recycling (e.g., depolymerization, advanced purification) is improving such that recycled PP is approaching the performance and safety needed even for food contact applications.

2. Regulatory Pressure & Circular Economy

- Governments, especially in Europe, and Asia, are tightening regulations on plastics. This includes mandates on minimum recycled content, rules on single-use plastics, Extended Producer Responsibility (EPR) schemes, and waste management directives.

- The idea of a circular economy is becoming mainstream: PP is increasingly seen not just as a virgin material but as part of closed loops where waste PP is collected, sorted, cleaned, and re-used.

3. Advanced PP Compounds & Material Improvements

- Manufacturers are developing PP compounds with improved mechanical properties—higher impact strength, flame retardancy, thermal stability, better clarity, lighter weight. These improvements are often achieved by blending PP with additives or using modified PP.

- Novel PP grades such as high melt strength (HMS-PP) are being scaled up.

4. Growth in End-Use Sectors: Automotive, Packaging, Healthcare

- Automotive / Electric Vehicles (EVs): Demand for lightweight, durable materials is pushing more use of PP in interior trims, battery closures, under-the-hood components, and structural components where toughness and cost matter.

- Packaging: E-commerce continues to grow; food & beverage packaging demands are rising, especially for rigid, flexible, and barrier PP packaging. Also, food-grade recycled PP is increasingly required.

- Healthcare & Medical: Non-woven PP (masks, gowns, wipes), medical devices, and sterile packaging continue to be major growth areas.

5. Technology, Digitalization, and Smart Systems

- Use of AI, machine learning, and automation in sorting, detecting contaminants, and achieving purer recycled PP streams.

- Traceability, track & trace, blockchain, or digital passports for materials to verify recycled content, origin, compliance, and safety.

6. Regional Expansions and Capacity Additions

- Asia-Pacific region continues to be a hotspot: rising demand for packaging, growing economy, increasing consumer awareness, and regulatory push.

- Major investments and capacity expansions are being announced in the Middle East, Latin America, and Southeast Asia.

Opportunities

- Companies that can develop food-grade recycled PP that meets regulatory safety standards will gain a competitive edge, since demand from brands is high.

- Producers of PP compounds with specialty properties (thermal, flame, impact, clarity) will find new applications, especially in EVs, appliances, packaging with barrier requirements.

- Technological providers: those offering advanced recycling technologies, sorting/separation systems, purity testing, traceability/blockchain platforms, etc., are likely to grow.

- Regulatory incentives in many countries (tax breaks, mandates, procurement policies) will favor recycled content, lower carbon footprints, and environmentally certified polymers.

Challenges & Risks

- Quality & Safety Standards: Ensuring recycled PP is safe for food contact and medical use is non-trivial; contamination, trace amounts of unwanted chemicals, or inconsistent purity remain barriers.

- Cost Pressures: Recycled PP and bio-based PP often cost more (due to processing, purification, raw material costs) than virgin PP, especially where virgin PP feedstock is cheap. Scaling up to reduce costs is essential.

- Collection & Sorting Infrastructure: In many parts of the world, the systems for waste collection, sorting, and recovery are still underdeveloped or inefficient, which limits the availability of high-quality feedstock.

- Regulatory Fragmentation: Different jurisdictions have different rules (e.g. food contact laws, recycled content mandates, labeling). Companies operating globally have to manage complex compliance.

- Supply Chain Transparency & Trust: Claims about recycled content, bio-based origin, carbon footprint, etc., need to be verifiable; greenwashing risks can damage reputation. Technologies like blockchain help, but adoption has costs and operational challenges.

What to Watch in 2026

- Rollout of new PP recycling plants (mechanical & chemical) capable of producing food-safe resin.

- Emergence or widening of PP grades certified under circular economy programs (e.g. ISCC PLUS, mass balance accounting, etc.).

- More brands publishing commitments to % recycled content in packaging, especially in regions with strong regulation (EU, Japan, parts of SE Asia).

- Innovative PP composites: blending with renewable fillers, bio-additives, or modified morphology to improve performance without harming recyclability.

- Policies: tighter regulations on single-use plastics, mandates for recycled content, incentives/subsidies for sustainable polymers.

- Consumer demand for transparency: labels, QR codes, digital product passports showing material origin, recyclability, etc.

By 2026, polypropylene is expected not only to remain a dominant material in many sectors (packaging, automotive, healthcare) but to shift decisively toward more sustainable, circular, and high-performance versions of itself. The biggest differentiators for success will be:

- Achieving high-quality recycled or bio-based PP

- ensuring regulatory compliance, particularly in food/medical applications

- investing in infrastructure and technology for recycling, sorting, and traceability

- aligning with market demands (consumer, brand, regulation) for sustainability

For businesses and stakeholders, those who move early to align their PP supply chains with circularity, transparency, and performance are likely to gain both competitive advantage and regulatory favor.